How To Guides for Exporting

Does your company plan to export goods?

These export guides will help your company plan and commence exporting. We outline the various steps of the export process and provide the most up-to-date international trade information for your company. These guides assist you with the fundamentals of exporting.

We provide companies with specialised assistance and guidance on how to begin exporting or grow the volume of goods and services they sell abroad. ICS Global Services is available to help your business expand internationally.

Basic Guide To Exporting

Almost every problem a new exporter could have been covered within these export guides. These guides provide an overview of the fundamentals of exporting and are designed for small to medium-sized companies that are thinking about exploring new international markets.

Our how to guide for exporting will assist you in preparing your business for export and positioning it for international economic success. Our guides give an overview of some of the most common export requirements, such as tariff classification, customs valuation, Incoterms®, and export and import customs requirements.

The Benefits of Exporting for Business

A key component of expanding your international business is exporting your products and services overseas. Our how to guides for exporting will help your company realise the benefits of exporting.

Export Benefits

Helps companies reach higher growth levels.

Extends the commercial life of goods and services by locating new markets and clients.

It increases a company's ability to innovate and compete.

Aids companies in boosting profits and revenues.

Increases a company's visibility and recognition globally.

Disperses business risks.

Greatly enhances the balance sheet and financial performance.

Exporting Guides

Exporting to the USA

Our how to guides for exporting examine the process for exporting goods to the USA, trade agreements with the USA, export controls, regulations, importer of record obligations, documentation, and compliance requirements. It also explores the advantages and considerations for businesses seeking to enter the U.S. market.

Exporting to Canada

The exporting of goods to Canada, trade agreements, export restrictions, regulations, importer of record obligations, documentation, and compliance requirements are all covered in our export guides. They also explore the advantages and considerations for businesses looking to enter the Canadian market.

Exporting from the UK

The export process for exporting goods from the UK can be complicated, especially now that Brexit has changed many of the laws and regulations. Our how-to guides for exporting examine the process for exporting goods from the UK.

Export Case Studies

These sample case studies give a thorough insight into the various export projects I have worked on. I take great pride in my work and the partnerships I have with my clients. Collaborating side by side with clients to comprehend their problems, difficulties, aims, and objectives before creating plans to optimise their global exports. I have extensive experience in a wide range of industries and businesses, which has given me a unique perspective on international commerce. This expertise is documented in my how to guides for exporting.

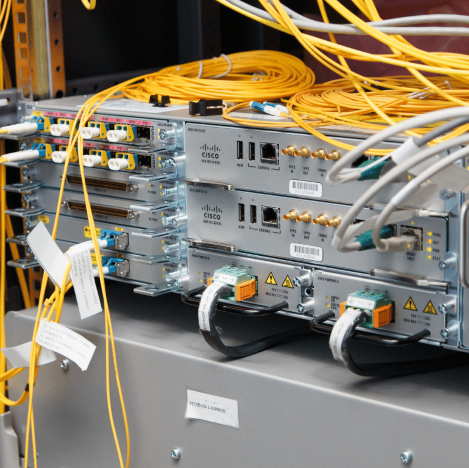

The client was experiencing difficulties supplying telecom equipment internationally and required a global business solution.

The Client required a post-Brexit alternative solution for their European supply chain operation serviced from the UK.

Export Blogs

Get in touch

Get in touch to learn more about our export guides, solutions, and support.